Understand the key payroll differences between casual, part-time, and full-time employees. Learn how correct classification impacts wages, leave, compliance, and business costs.

Learn what accounts receivable is, how it affects your business cash flow, and practical ways to manage it effectively. Discover why proper receivables management is crucial for small business success.

Discover how a registered BAS agent helps businesses save time, reduce stress, ensure ATO compliance, and avoid costly GST & BAS mistakes in 2026.

What is bookkeeping and why every Australian small business needs it? Discover powerful benefits, compliance tips and financial clarity in this 2026 guide.

Whether you’re planning to expand your business, secure a loan, or attract investors, one thing can make or break your chances of success: proper bookkeeping. For many lenders and investors, financial records tell the real story of your business—its strength, stability, and future potential. Without accurate, up-to-date bookkeeping, your business may struggle to prove its […]

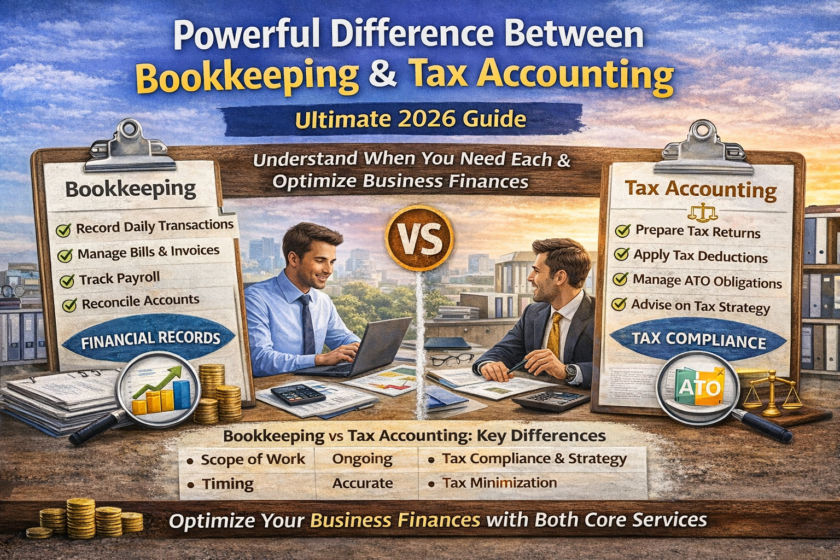

Discover the powerful difference between bookkeeping and tax accounting, when you need each, and how to optimise your business finances in this ultimate 2026 guide.

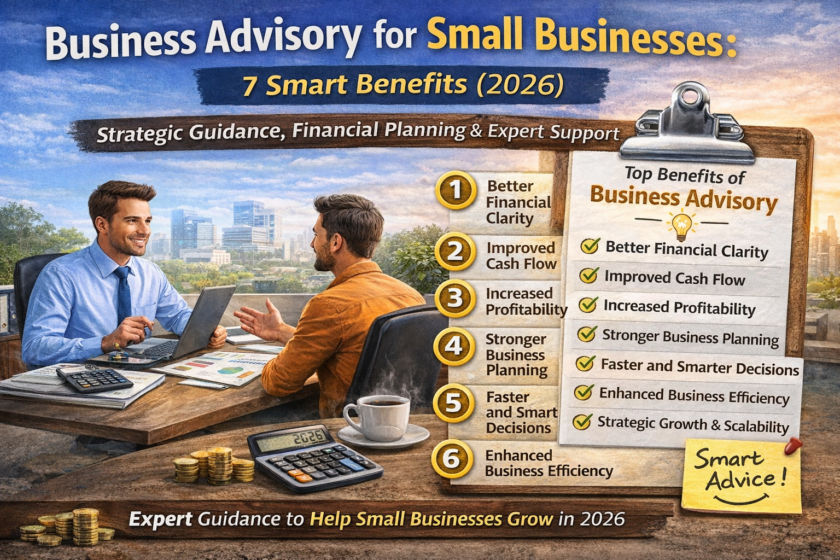

Discover how business advisory helps small businesses grow. Learn 7 smart benefits of strategic guidance, financial planning, and expert support in 2026.

Learn the essential GST & BAS rules every WA small business must follow in 2026. Smart tips to stay compliant, avoid penalties, and manage tax with confidence.

Discover why every small business needs a financial advisor. Learn how expert guidance improves cash flow, reduces risks, boosts growth & ensures long-term success.

Avoid ATO penalties in 2026 by fixing common BAS mistakes. Learn the top 5 BAS errors and how to stay compliant with expert bookkeeping tips.