The Powerful Difference Between Bookkeeping and Tax Accounting — When You Need What

Managing business finances requires more than just tracking numbers. It demands clarity, structure, and strategic oversight. Many businesses struggle because they fail to understand the difference between bookkeeping and tax accounting, often assuming they are interchangeable. We know they are not. Each plays a distinct, essential role in maintaining financial health, ensuring compliance, and enabling sustainable growth.

This comprehensive guide clearly explains how bookkeeping and tax accounting differ, when each is required, and how using them together creates a financially resilient business.

Understanding Financial Roles in Modern Businesse

Financial management is no longer a back-office function. It directly influences profitability, scalability, and compliance. Businesses that separate operational record-keeping from tax-focused financial strategy consistently perform better.

We view bookkeeping as the engine that keeps finances running daily, while tax accounting acts as the navigation system, guiding the business through regulatory and tax landscapes.

What Is Bookkeeping? A Foundation for Financial Accuracy

Bookkeeping refers to the systematic recording, categorisation, and maintenance of all financial transactions within a business. It focuses on accuracy, consistency, and real-time visibility.

Core Bookkeeping Functions

- Recording sales, expenses, and payments

- Managing invoices and supplier bills

- Reconciling bank and credit card accounts

- Tracking payroll and superannuation

- Maintaining ledgers and financial records

Bookkeeping ensures that every financial activity is documented, traceable, and aligned with accounting standards.

Why Bookkeeping Is Business-Critical

Without reliable bookkeeping, businesses operate blindly. Cash flow issues, missed payments, and inaccurate reporting often stem from poor bookkeeping practices. We rely on accurate bookkeeping to:

- Monitor financial performance

- Maintain cash flow control

- Prepare reliable reports

- Support informed decision-making

Bookkeeping is not optional; it is operationally essential.

Also Check: Bookkeeping & Reconcile Services Perth 2026

What Is Tax Accounting? Compliance Meets Strategy

Tax accounting focuses specifically on tax obligations, reporting, and optimisation. It applies tax legislation to financial data to ensure compliance while identifying lawful tax efficiencies.

Core Tax Accounting Responsibilities

- Preparing and lodging tax returns

- Managing GST, BAS, and PAYG obligations

- Applying depreciation and deductions

- Structuring transactions tax-effectively

- Advising on tax planning and risk mitigation

Tax accounting does not track daily transactions. Instead, it analyses financial records—often prepared by bookkeepers—to calculate tax liabilities accurately.

The Strategic Value of Tax Accounting

We use tax accounting to protect businesses from:

- Penalties and interest

- ATO audits and disputes

- Overpayment ofology

- Structural inefficiencies

Tax accountants ensure businesses meet obligations while retaining as much profit as legally possible.

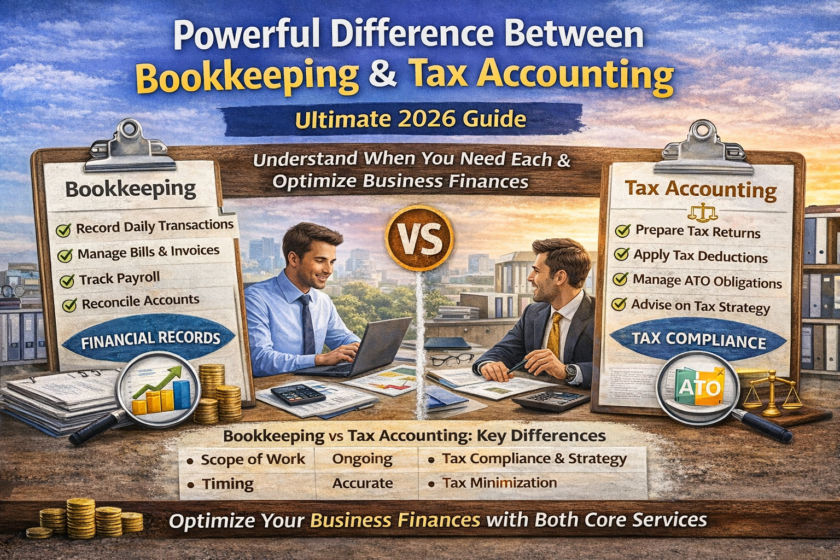

The Difference Between Bookkeeping and Tax Accounting Explained Clearly

Understanding the difference between bookkeeping and tax accounting eliminates costly mistakes.

Scope of Work

- Bookkeeping: Daily transaction management

- Tax Accounting: Tax compliance and planning

Timing

- Bookkeeping: Ongoing and continuous

- Tax Accounting: Periodic and deadline-driven

Primary Objective

- Bookkeeping: Financial accuracy and organisation

- Tax Accounting: Legal compliance and optimisation

Skill Sets

- Bookkeepers: Systems, reconciliation, reporting

- Tax Accountants: Tax law, strategy, compliance

Both roles are complementary but not interchangeable.

Also Check: Why Every Small Business Needs a Financial Advisor

When Businesses Need Bookkeeping Services

We recommend professional bookkeeping when:

Businesses Are Starting Out

Early-stage businesses need structure from day one. Bookkeeping establishes financial discipline and prevents long-term issues.

Transaction Volumes Increase

As sales grow, manual tracking becomes risky. Professional bookkeeping ensures accuracy at scale.

Real-Time Financial Visibility Is Required

Cash flow forecasting, budgeting, and reporting depend on current data. Bookkeeping provides this visibility.

When Businesses Need Tax Accounting Services

Tax accounting becomes essential when:

The Financial Year Ends

Annual tax returns, reconciliations, and compliance reviews require expert oversight.

Business Structures Become Complex

Companies, trusts, and partnerships face more sophisticated tax obligations.

Regulatory Risk Exists

Audits, reviews, or past non-compliance demand professional tax intervention.

Also Check: Why Every Small Business in Australia Needs a Local Bookkeeper

Why Bookkeeping and Tax Accounting Work Best Together

Businesses achieve the strongest financial outcomes when bookkeeping and tax accounting operate in alignment.

Clean Data Enables Better Tax Outcomes

Accurate bookkeeping reduces accounting costs and maximises deductions.

Integrated Financial Oversight

When bookkeepers and tax accountants collaborate, businesses benefit from:

- Fewer errors

- Faster reporting

- Strategic tax planning

- Improved cash flow

Separating these roles creates inefficiencies and increases risk.

Common Misconceptions That Hurt Businesses

“Our Accountant Handles Everything”

Accountants rely on bookkeepers for accurate data. Without it, costs rise and errors increase.

“Software Replaces Professionals”

Software records data. Professionals interpret, correct, and optimise it.

“We Only Need Help at Tax Time”

Financial issues rarely originate at tax time—they accumulate year-round.

The Financial Cost of Getting It Wrong

Failing to understand the difference between bookkeeping and tax accounting leads to:

- ATO penalties and interest

- Overpaid taxes

- Poor cash flow decisions

- Lost growth opportunities

- Increased stress and inefficiency

Proactive financial management prevents reactive damage control.

Also Check: Why Every Small Business Needs a Financial Advisor

How JGW Bookkeeping Services Supports Financial Success

We provide professional bookkeeping services designed to support seamless tax accounting outcomes.

Tailored Bookkeeping Solutions

Our services adapt to business size, industry, and growth stage.

Tax-Ready Financial Records

We ensure records are accurate, compliant, and ready for tax professionals.

Australian Compliance Expertise

Local knowledge ensures adherence to Australian tax and regulatory requirements.

By maintaining clean financial systems, we empower businesses to operate confidently and strategically.

Future-Proofing Business Finances

Cloud-Based Bookkeeping

Real-time access improves transparency and decision-making.

Proactive Tax Planning

Early planning reduces liabilities and improves cash flow.

Data-Driven Strategy

Financial data becomes a growth tool, not just a compliance requirement.

Conclusion: Knowing the Difference Creates Financial Control

The difference between bookkeeping and tax accounting is not technical—it is strategic. Bookkeeping ensures financial clarity. Tax accounting ensures legal compliance and optimisation. Together, they form a complete financial framework that supports growth, stability, and peace of mind.

Businesses that understand when to use each service—and how they complement one another—position themselves for long-term success.