Understanding Business Advisory: What It Means, and How It Helps Your Business

Running a business—whether small, medium, or scaling rapidly—comes with countless decisions that can shape the future of your company. From financial planning and cash flow management to strategic growth and risk assessment, business owners are often stretched between day-to-day operations and long-term planning. This is where Business Advisory services step in.

In today’s competitive landscape, having a trusted advisor can be the difference between surviving and thriving. Business advisory provides expert guidance, strategic insights, and practical solutions that empower business owners to make smarter decisions, operate efficiently, and grow sustainably.

This guide will help you understand what business advisory really means, what advisors do, and how their services can help your business succeed.

1. What Is Business Advisory?

Business advisory is a professional service offered by experts—often accountants, financial consultants, or specialised advisors—who guide business owners on how to improve performance, solve challenges, and achieve growth. Unlike traditional bookkeeping or tax work, which is reactive, business advisory is proactive and future-focused.

A business advisor helps you:

- Analyse your financial health

- Identify opportunities for improvement

- Solve operational challenges

- Develop strategies for sustainable growth

- Make informed decisions

- Navigate market changes and risks

They become a partner who understands your business inside out, helping you stay on track to achieve your goals.

Also Check: The Ultimate Guide to Bookkeeping Services for Small Businesses in Perth (2025)

2. Key Areas Covered by Business Advisory Services

Business advisory services cover a wide range of strategic and operational areas. Some of the most common include:

✔ Financial Performance Analysis

Advisors assess financial statements, profitability, cash flow trends, and expenses to identify strengths, weaknesses, and growth opportunities.

✔ Cash Flow Management

Poor cash flow is one of the biggest reasons businesses fail. An advisor helps forecast, monitor, and improve cash flow to keep your operations stable.

✔ Budgeting & Forecasting

Accurate budgeting and future planning allow you to make confident decisions, allocate resources wisely, and prepare for growth.

✔ Business Strategy & Planning

Advisors work with you to set realistic goals and develop clear, actionable strategies to reach them.

✔ Risk Management

From compliance risks to market threats, advisors help you anticipate challenges and create contingency plans.

✔ Tax Planning

Advisors provide guidance on tax strategies to legally minimise tax obligations and improve financial efficiency.

✔ System and Process Improvement

They help streamline business processes, introduce automation, and recommend tools that improve productivity.

✔ Operational Efficiency

Advisors analyse business workflows and suggest ways to reduce cost, eliminate time-wasting tasks, and enhance output.

✔ Business Structure Advice

Choosing the correct structure—sole trader, partnership, trust, or company—has tax and legal implications. Advisors provide insight based on your business goals.

✔ Growth & Expansion Planning

Whether you’re scaling locally or expanding into new markets, an advisor helps you plan strategically.

Also Check: Payroll Outsourcing Services in Perth: Is It Right for Your Business?

3. Why Business Advisory Matters in Today’s Business Environment

The business world is evolving quickly—technology, competition, customer expectations, and global shifts impact small and medium businesses more than ever before.

Here’s why advisory services are becoming essential:

📌 Advisors Bring Expertise You May Not Have

Most business owners are experts in their products or services—but not in financial analysis, growth strategy, or risk management.

📌 They Offer an Objective, Outside Perspective

Sometimes you’re too close to your business to see issues clearly. Advisors bring clarity and unbiased insights.

📌 Advisory Helps You Stay Competitive

With strategic planning, financial forecasting, and market analysis, you stay ahead of competitors.

📌 It Reduces Costs and Prevents Mistakes

Wrong decisions, poor budgeting, and bad investments can be expensive. Advisors help you avoid common pitfalls.

📌 They Keep You Focused on Long-Term Vision

Daily operations can distract you from your goals. Advisory keeps your business aligned with its long-term plan.

Also Check: 5 Common BAS Errors and How to Avoid ATO Penalties in 2026

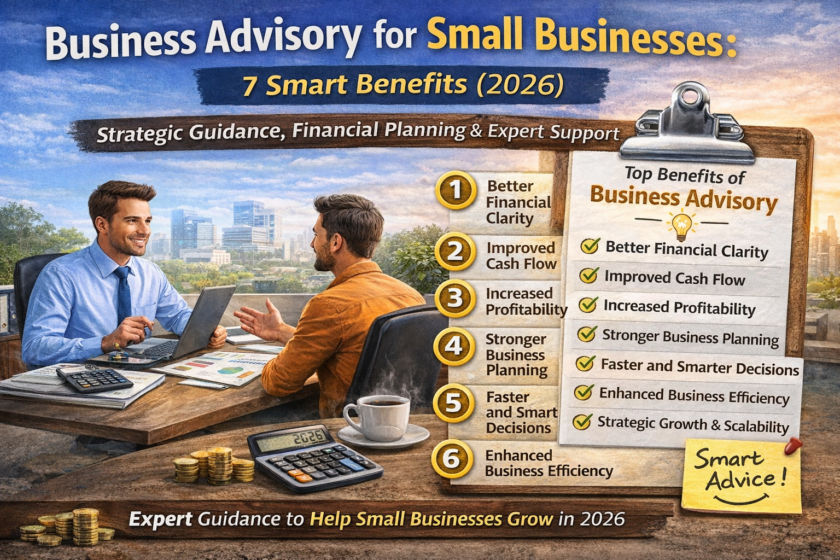

4. How Business Advisory Helps Your Business

1. Better Financial Clarity

An advisor breaks down your numbers, helping you understand exactly how your business is performing. You gain insights into profit margins, spending patterns, and areas of risk.

2. Improved Cash Flow

Through cash flow forecasting, monitoring, and planning, your business becomes more stable and better prepared for slow seasons or unexpected expenses.

3. Increased Profitability

Advisors identify ways to reduce unnecessary costs, optimise pricing, and improve profit margins.

4. Stronger Business Planning

They help you develop step-by-step action plans that guide your daily decisions and long-term strategy.

5. Faster and Smarter Decisions

With real-time insights and data-backed recommendations, you avoid guesswork and make better choices.

6. Enhanced Business Efficiency

Advisors find inefficiencies in your processes and help you streamline workflows to boost productivity.

7. Strategic Growth and Scalability

Whether you want to expand, hire employees, open new branches, or diversify services, advisors guide you through the entire process.

8. Risk Reduction

With expert guidance, your business becomes more resilient, compliant, and prepared for financial or operational challenges.

9. Better Tax Outcomes

Advisors help reduce tax liabilities while keeping your business legally compliant.

10. Peace of Mind

Knowing you have a knowledgeable professional supporting you brings confidence and reduces stress.

Also Check: Why Every Small Business Needs a Financial Advisor

5. When Should You Consider Hiring a Business Advisor?

You may need advisory services if:

- Your business is growing quickly

- You’re facing financial or operational challenges

- You’re unsure how to increase profitability

- You’re planning expansion or new investments

- You want better control over cash flow

- You are overwhelmed with decision-making

- You want long-term structure and direction

Small and medium businesses benefit the most from timely advisory support.

6. What Makes a Great Business Advisor?

A high-quality advisor should have:

- Deep financial knowledge

- Strong analytical skills

- Industry experience

- Problem-solving ability

- Good communication

- A genuine interest in your business

- A proactive and strategic mindset

They should become your trusted partner, not just a consultant.

7. Business Advisory vs Bookkeeping: What’s the Difference?

Many business owners assume bookkeeping and advisory are the same, but they are not.

Bookkeeping

Tracks financial transactions, reconciles accounts, and prepares financial records.

Business Advisory

Interprets those records, finds opportunities for improvement, and plans your financial future.

Both are important, but advisory takes your business to the next level.

Conclusion: Why Business Advisory Is a Smart Investment

Business advisory services provide clarity, strategy, and support that help business owners overcome challenges and achieve long-term success. Whether you’re looking to grow, improve your financial performance, stabilise cash flow, or optimise operations, an advisor plays a crucial role in guiding your business forward.

With expert support, you can make smarter decisions, avoid costly mistakes, and build a thriving business with confidence.